Bitcoin is down about 40% from its all-time high, compared with a 10% decline in the Nasdaq 100 Index.

The crypto market was in a sea of red on Friday as bitcoin, the world’s largest cryptocurrency by market capitalization, tumbled more than 10% over the past 24 hours.

It appears that global investors have entered the year with a reduced appetite for risk, and so the correlations between speculative assets such as cryptocurrencies and equities have increased, which results in widespread losses. Bitcoin is down roughly 40% from its all-time high of almost $69,000, while the S&P 500 is down about 7% from its peak, compared with a 10% drawdown in the Nasdaq 100 Index.

Alternative cryptocurrencies (altcoins) led the way lower on Friday given their higher risk profile relative to bitcoin. Ether, the world’s second-largest cryptocurrency by market cap, was down about 13% over the past 24 hours, compared with a 14% drop in AVAX and a 16% drop in FTM over the same period.

Despite the losses, some analysts still foresee a short-term bounce. “We expect BTC to find a bid around the $35K mark, close to 50% from the top. In the short term, we can bounce to challenge the $45K-$50K zone, but the overall outlook remains bearish as liquidity remains tight,” Pankaj Balani, CEO of Delta Exchange, a crypto derivatives trading platform, wrote in an email to CoinDesk.

For now, technical indicators show nearby support at about $37,000 for bitcoin, although stronger support at $30,000 could stabilize a deeper correction.

“Many altcoins are into support at their summertime 2021 lows, making it critical that bitcoin holds support as it sets the tone for the cryptocurrency space,” Katie Stockton, managing director of Fairlead Strategies, a technical research firm, wrote in a Friday briefing. Stockton assigns a 30%-70% probability of a continued breakdown below current BTC price levels.

Latest prices

●Bitcoin (BTC): $38349, −9.92%

●Ether (ETH): $2752, −13.62%

●S&P 500 daily close: $4398, −1.89%

●Gold: $1832 per troy ounce, −0.57%

●Ten-year Treasury yield daily close: 1.75%

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at

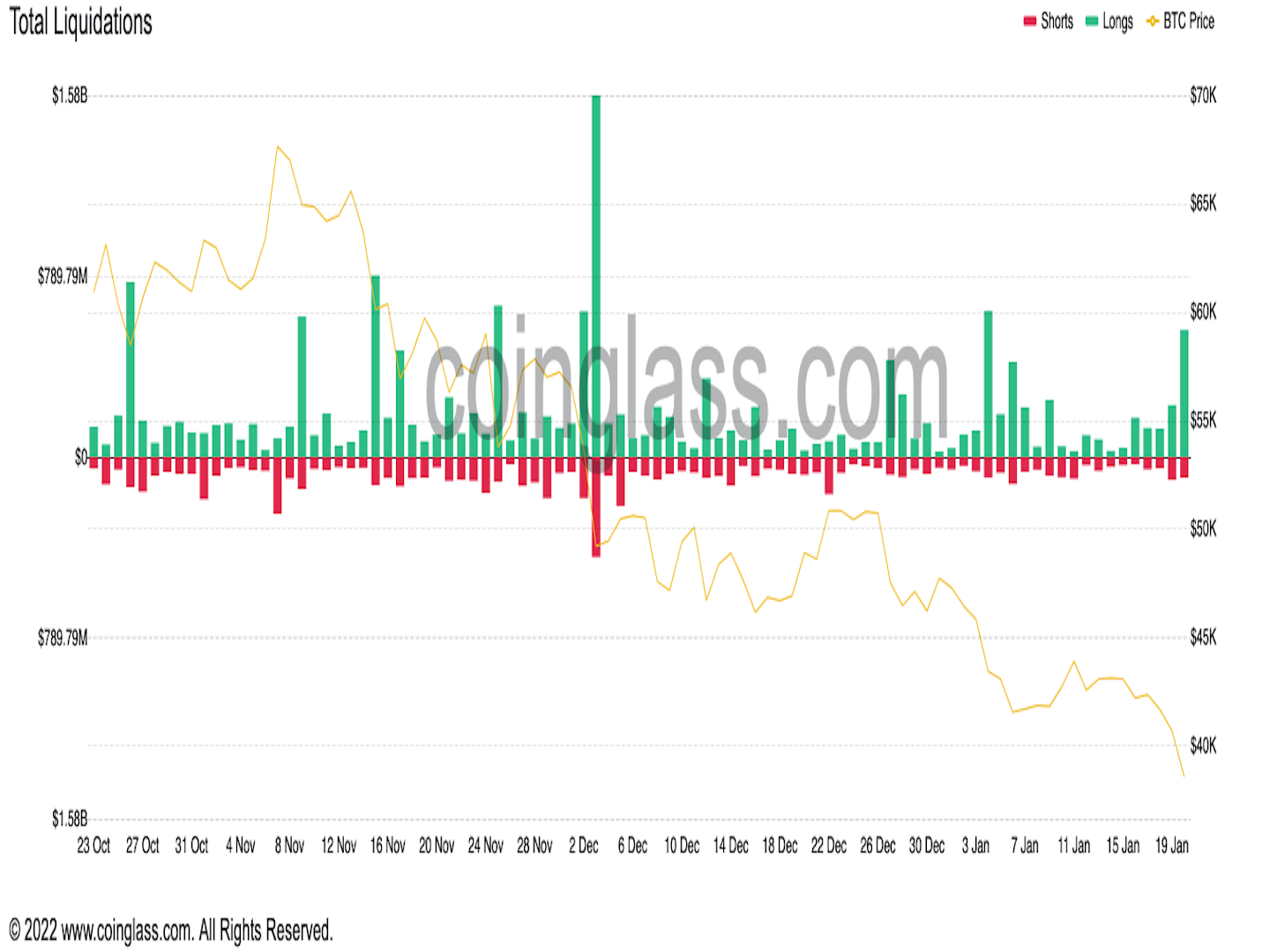

Liquidation spike

According to data from CoinGecko, the total market cap of the cryptocurrency industry has fallen 11% to $1.9 trillion as of Friday afternoon U.S. time from an all-time high of $3.1 trillion in November.

The drop in total market cap has exposed many crypto traders to significant risk. According to Coinglass, there has been nearly $600 million in liquidations during the last 12 hours. Bitcoin led the liquidation pack at $250 million, followed by ether at $163 million and SOL at $10.9 million.

According to OKLink, the liquidation volume on decentralized finance (DeFi) tokens reached $34.3 million on Friday, the highest since December.

Liquidations in the crypto market happen when a trader has insufficient funds to fund a margin call – or a call for extra collateral demanded by the exchange to keep the trading position funded. They are especially common in futures trading.

Bitcoin drawdown deepens

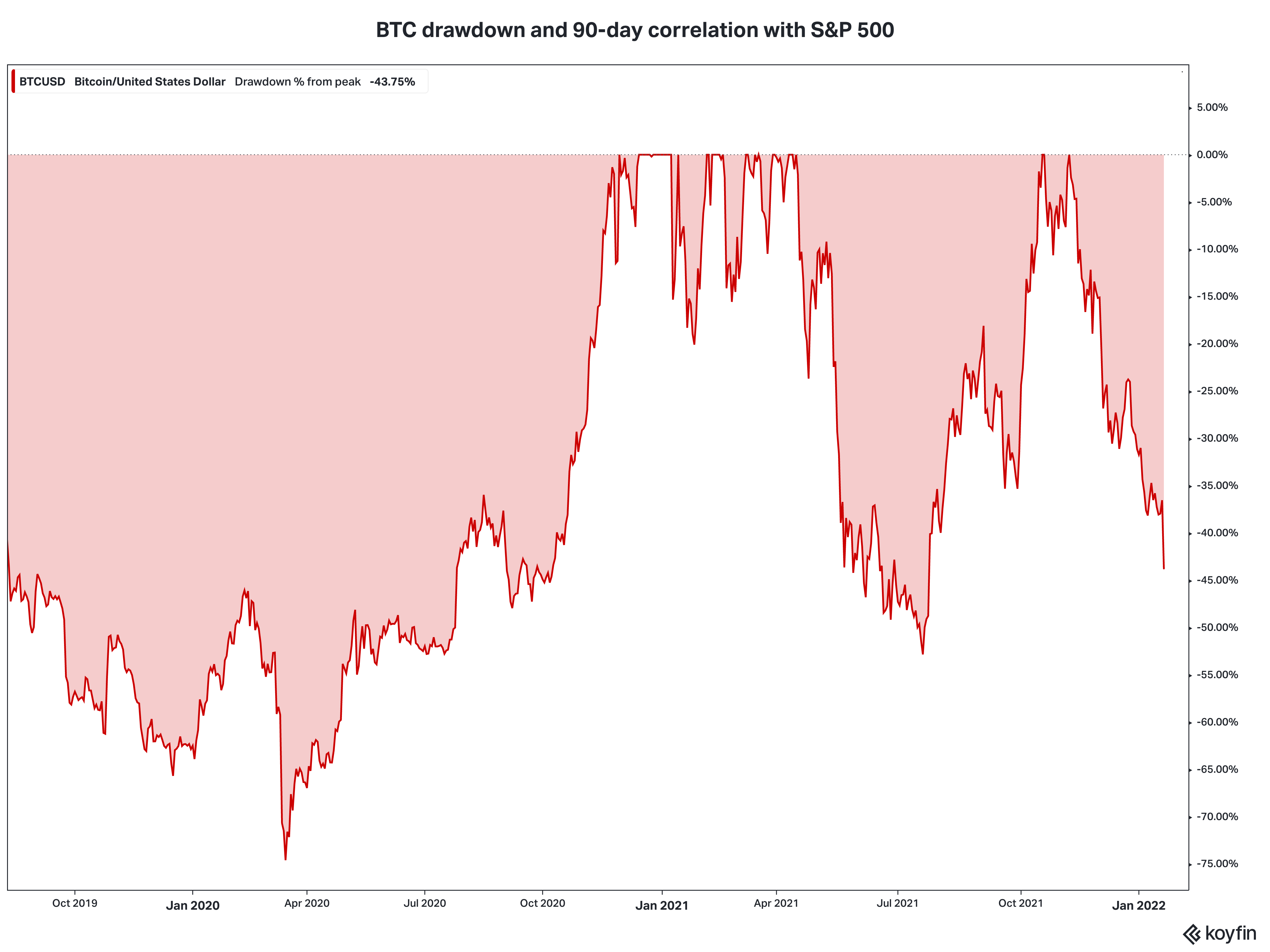

Bitcoin is roughly 40% below its all-time high of $69,000, which is a significant drawdown. The previous drawdown extreme was in July when BTC settled near $28,000 after falling roughly 50% from its peak. BTC is vulnerable to extreme losses, similar to what occurred in 2018 when the decline reached 80%.

Bitcoin’s peak-to-trough declines have been less severe over the past year, especially given the long-term uptrend in price and the decline in volatility.

The chart below, created using Koyfin, a financial data provider, shows bitcoin’s historical drawdown and the cryptocurrency’s 90-day correlation with the S&P 500 in the second panel.

Altcoin roundup

- Altcoin decoupling narrative goes up in smoke: The developing narrative of ether and altcoins decoupling from bitcoin in an adverse macro environment evaporated on Friday as a sell-off in stocks and the largest cryptocurrency caused extensive damage to the broader crypto market. All cryptocurrencies appear to be correlated to equities now. Even ether, which is more associated with DeFi and non-fungible tokens (NFT) than with the inflation trade, seems to be tracking equities, according to Omkar Godbole. Read more here.

- DeFi token demand dries up as traders exit: DeFi tokens are among the worst performers in Friday’s gloomy market. Fantom, AVAX, LUNA and UNI have all plunged by more than 10% over the past 24 hours. Some analysts have been bullish on DeFi and DAO (decentralized autonomous organization) tokens while being bearish on bitcoin, according to a recent report published by Huobi, a crypto exchange. But reality has shown otherwise so far. Uniswap’s UNI token hit its all-time high transaction volume, or more than 61% above the volume in last year’s fourth quarter, Messari wrote in a report.

- SundaeSwap’s rocky start: The first decentralized cryptocurrency exchange on the Cardano blockchain went live this week, but users have complained that transactions are failing and they aren’t receiving their swapped tokens. Similar to UNI, which powers Uniswap, SundaeSwap has its own token, SUNDAE, but the data websites CoinMarketCap and CoinGecko don’t have any pricing information, according to Lyllah Ledesma. Read more here.

Relevant news

- Newly Public Core Scientific Leads Slump in Crypto Mining Stocks

- Crypto-Exposed Stocks Sink Amid Bitcoin’s Decline, Broader Market Rout

- FTX Readies Visa Debit Card for Users to Spend Crypto Balances

- Binance Didn’t Upgrade Customer Checks, Despite Promises to Regulators: Report

- Andrew Rogozov, Former Exec at VK, the ‘Facebook of Russia,’ Joins Telegram’s Spin-Off Blockchain Project

Other markets

Most digital assets in the CoinDesk 20 ended the day lower.

There were no gainers in the CoinDesk 20 on Friday.

Largest losers:

| Asset | Ticker | Returns | Sector |

|---|---|---|---|

| Polygon | MATIC | −14.4% | Smart Contract Platform |

| Chainlink | LINK | −14.3% | Computing |

| Ethereum | ETH | −13.8% | Smart Contract Platform |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive, and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.

DISCLOSURE

This is just for information make your own decision.

What is Michael Saylor’s net worth?

Saylor co-founded and leads MicroStrategy. The company is a company that provides business intelligence, mobile software, and cloud-based services. He authored the book ‘The Mobile Wave: How Mobile Intelligence Will Change Everything in 2012.’ Saylor is also the sole trustee of Saylor Academy.

As of 2022, Michael Saylor’s net worth is estimated to be roughly 1.5 billion.

Early Life

Michael J. Saylor was born on the 4th of February, 1965, in Lincoln, Nebraska. He spent his early years on various Air Force bases around the world, as his father was an Air Force chief master sergeant.

In 1983, Saylor attended the Massachusetts Institute of Technology on an Air Force ROTC scholarship. He then joined the Theta Delta Chi fraternity, through which he met the future co-founder of MicroStrategy, Sanju K. Bansal.

Career

Saylor was the valedictorian of his high school. He graduated in the top one percent of his class. He joined The Federal Group, Inc, in 1987 and DuPont in 1988.

Saylor co-founded and is the chairman of the board and chief executive officer of MicroStrategy Incorporated. They provide mobile software, cloud-based services, and business intelligence.https://f7f94cc4a800052494d6ad5ee6b40b7a.safeframe.googlesyndication.com/safeframe/1-0-38/html/container.html

MicroStrategy won a $10 million contract with McDonald’s in 1992. Saylor developed a subsidiary called Angel in 1997 and the company was sold for $110 million in cash.

In 1999, Saylor established The Saylor Foundation. To support his goal of making free education to students, Saylor.org was launched in 2008. The site offers 100 college courses that are supported by free content from universities including MIT and Carnegie Mellon University.

In 2000, the company’s net worth had reached $7 billion. The same year the U.S. Securities and Exchange Commission brought charges against him and his net worth dropped by $6 billion

In 2012, Saylor wrote ‘The Mobile Wave: How Mobile Intelligence Will Change Everything,’ and the book made the New York Times Best Seller list.

He was named by People Magazine as one of its Most Eligible Bachelors in 2000. He established The Saylor Foundation in 1999 to make free education available to all students.https://f7f94cc4a800052494d6ad5ee6b40b7a.safeframe.googlesyndication.com/safeframe/1-0-38/html/container.html

As of 2022, Michael Saylor’s net worth is estimated to be roughly $500 million.

How Does Michael Saylor Spend His Money?

Michael Saylor spends his money on real estate.

Michael Saylor’s Home

Saylor owns a home in McLean, Virginia.

Highlights

Here are some of the best highlights of Michael Saylor’s career:

- The Federal Group, Inc (1987)

- DuPont (1988)

- He co-founded and is the chairman of the board and chief executive officer of MicroStrategy Incorporated

Favorite Quotes from Michael Saylor

“Bitcoin is a bank in cyberspace, run by incorruptible software, offering a global, affordable, simple and secure savings account to billions of people that don’t have the option or desire to run their own hedge fund.” – Michael Saylor

“I grew up in a family where no one had written a newspaper or magazine article about anybody in my family for a hundred years, right? ” – Michael Saylor

“We’re in an inflection point where it’s cheaper to learn to read on a tablet computer than it is to learn to read on paper. It’s only a matter of time before every 6-year-old kid has a tablet computer, and we know for a fact, 3- to 4-year-old kids are using tablets and iPads, and 75 and 80-year-olds are using them.” – Michael Saylor

“There’s nothing more frustrating than seeing cynics sit there and say. Nobody can make any more money because Microsoft and Intel own everything. The software industry mature, or is it embryonic? I would say it’s embryonic. There will be a hundred more Microsofts, not just one.” – Michael Saylor

“The basis of the free market is anytime you can generate revenue or profit, you’ve created value in excess of the resources you consume in a society.” – Michael Saylor

“Industries that fall first are the industries that either produce electromechanical items that are now inferior to their software substitutes. The industries that produce a mechanically created service that’s now inferior.” – Michael Saylor

3 Awesome Lessons from Michael Saylor

Now that you know all about Michael Saylor’s net worth and how he achieved success; let’s take a look at some of the lessons we can learn from him: https://f7f94cc4a800052494d6ad5ee6b40b7a.safeframe.googlesyndication.com/safeframe/1-0-38/html/container.html

1. Building a Company

When you’re building a company, you need to continually strengthen every component – finance, strategic partnerships, executive team, and relationships with every last constituency.

2. Companies

Companies that make keys, credit card companies, any company in the service business – anything to do with a consumer is probably a software company.

3. Industries

The industries that fall first are the industries that either produce electromechanical items that are now inferior to their software substitutes, or the industries that produce a mechanically created service that’s now inferior.https://f7f94cc4a800052494d6ad5ee6b40b7a.safeframe.googlesyndication.com/safeframe/1-0-38/html/container.html

Summary

Michael Saylor is an American entrepreneur and businessman. Saylor is an investor and entrepreneur with 29 patents to his name in the areas of security, automation, and business intelligence. Saylor was born in Lincoln, Nebraska, in 1965.

As of 2022, Michael Saylor’s net worth is estimated to be roughly 1.5 billion.

#1362 Michael Saylor$1.7B

REAL TIME NET WORTH

as of 1/22/22Photo by Jamel Toppin/The Forbes Collection

- Michael Saylor is the CEO of business analytics software firm MicroStrategy.

- One of the best-known executives of the Internet bubble, Saylor was a multibillionaire in the late 1990s thanks to his stake in MicroStrategy.

- He fell from the billionaire ranks after questionable accounting led to a restatement of financial results and the dot-com bust crashed the stock.

- He’s a billionaire again thanks to timely bitcoin investments. In October 2020, he disclosed he personally bought 17,732 bitcoins for $175 million.

- Throughout 2020 he steered Microstrategy’s corporate coffers into bitcoin, using company cash and borrowings to buy 70,784 bitcoins for $1.1 billion.

- A former rocket scientist, Saylor studied aeronautics and astronautics at MIT on an Air Force scholarship before founding MicroStrategy in 1989.

ON FORBES LISTS#1362Billionaires 2021#4Crypto Rich List 2021Personal StatsAge56Source of Wealthcryptocurrency, Self MadeResidenceVienna, VirginiaCitizenshipUnited StatesMarital StatusSingleEducationBachelor of Arts/Science, Massachusetts Institute of TechnologyDid you know Saylor helped trigger the institutional bitcoin boom in December 2020, when MicroStrategy’s bitcoin ownership crossed the $1 billion milestone.Net worth over time$2.3BBillionaires

April 2021Key Connections