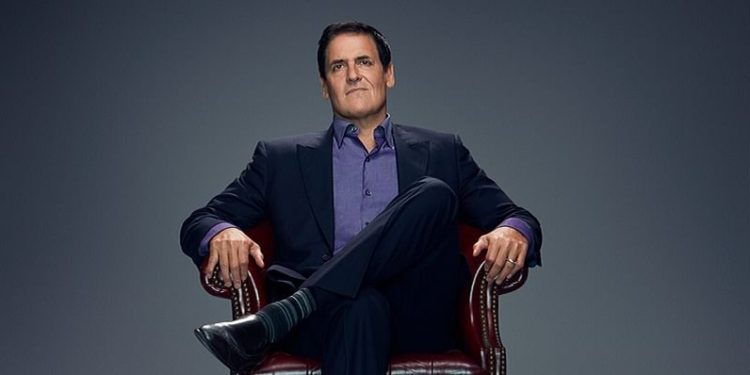

Investor Mark Cuban made billions of dollars during the dot-com boom by hedging his portfolio after selling his company, Broadcast.com, to Yahoo in 1999 for $5.7 billion in stock. He is worth 4.3 billion dollars.

But Cuban wasn’t always an expert investor.

In fact, “I learned some expensive lessons when I first started trading stocks,” Cuban said Tuesday during an “Ask Me Anything” session on Reddit. “It was painful.”

Cuban had responded to a user asking for advice for those who recently lost money amid the GameStop trading frenzy, as the AMA was hosted by subreddit WallStreetBets, the same group that made headlines for helping the video game retailer’s stock price surge.

Back then, ”[I] tried to learn what I got right and wrong,” Cuban said. But ”[r]ight now, right here. The game is changing.”

For his own investments, when deciding whether to hold or sell a stock, “BTC HODLers are a great example to follow,” Cuban said, referring to bitcoin investors who hold their position in the cryptocurrency. “Many bought at the highs in 2017 and watched it fall by 2/3 or more. But they held on because they believed in the asset.”

The same thinking applies to stocks.

“When I buy a stock, I make sure I know why I’m buying it. Then I HODL until I learn that something has changed,” he said. “The price may go up or down, but if I still believe in the logic that made me buy the asset, I don’t sell. If something changed that I didn’t expect, then I look at selling.”

Cuban admits that trading stocks “isn’t easy” but “time-consuming and brain consuming,” he said in response to another Reddit user.

“As always DO THE WORK,” he said.

https://youtu.be/YzBvgsrIj6M?t=47