The Feds have raised rates to bring inflation down. All the while trying to kill Job growth and wage increases. By killing borrowing money. This is the only tool they have beyond raising bond rates so people will put their money in bonds. So this causes the stock market to sell off. You would think that people would be happy with more job growth and higher pay. The problem is we have never had a Pandemic that shut down the economy We had a leader at the time the killed 1 million Americans and did not give a damn. China has less death than any country.

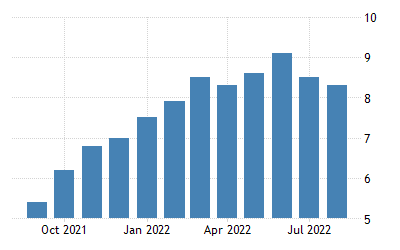

Inflation came in faster than expected in August even as gas prices fell.

+

14

%

+

12

Inflation

+

10

+

8

+8.3%

in August

+

6

+6.3%

excluding

food and

energy

+

4

+

2

0

–

2

1965

’70

’75

’80

’85

’90

’95

2000

’05

’10

’15

’20

Year-over-year percentage change in the Consumer Price Index

Source: Bureau of Labor Statistics

Fresh inflation data released on Tuesday showed that price gains did not moderate as much as anticipated in August, unwelcome news for the Biden administration and the Federal Reserve and a sign of the extent to which fast-climbing costs continue to plague consumers.

For policymakers at the Federal Reserve, who have been raising interest rates to slow the economy and try to tame recent rapid inflation, the data is further evidence that price increases have yet to show clear signs of coming back under control, even as central bankers wage a policy campaign to slow the economy and tamp down inflationary pressures.

Prices rose 8.3 percent from a year earlier, a rapid pace of increase for consumers and not as much of a slowdown as economists had expected, even as gas prices dropped and weighed on the overall numbers. At the same time, so-called core inflation re-accelerated notably in August. That measure strips out volatile food and fuel prices to give a better sense of underlying trends, and it tracks products like clothing and furniture along with an array of services.

The core gauge climbed by 6.3 percent in the year through August, compared with 5.9 percent in July. That pickup came partly because the August price gains are being measured against a relatively weak reading from the same month in 2021. When inflation is measured against a lower year-ago number, or “base,” it tends to appear faster.

But the report’s details also offered signs that underlying inflation pressures remain significant. While gas prices and used car and truck costs have begun to dip, other prices are rising fast enough to fully offset those declines: Prices climbed by 0.1 percent on a headline basis over the course of the past month as prices for meals at restaurants, rents and new vehicles picked up.

Such factors are likely to keep the Fed firmly in inflation-fighting mode. Central bankers are waiting for a sustained slowdown in price increases to convince them that their policies are working to cool demand and nudge the economy back toward a healthy environment in which inflation is slow, steady and barely noticeable. Until that happens, officials have pledged to keep raising interest rates, moves that can slow borrowing, constrain consumer demand and tamp down hiring and wage growth.

“Inflation is far too high, and it is too soon to say whether inflation is moving meaningfully and persistently downward,” Christopher Waller, a Fed governor, said in a speech last week. “This is a fight we cannot, and will not, walk away from.”

Officials are widely expected to make a three-quarter-point interest rate increase when they meet next week, which would be their third supersize move in a row. Policymakers have been clear that they hope to slow the pace of rate moves eventually, but they have said the timing will hinge on incoming data.

In fact, investors began to pencil in the possibility of an even bigger rate increase on the heels of Tuesday’s data. Stock prices swooned as Wall Street digested the possibility that the Fed might need to be even more aggressive in constraining the economy in order to wrangle an inflation problem that is worse than anything America has faced since the 1980s.

“Inflation remains hot, financial conditions have seen some improvement and the labor markets are humming along,” Neil Dutta, head of U.S. economics at Renaissance Macro, wrote in a research note following Tuesday’s data release. “If the goal is to slow things down and create some pain, the Fed is failing by its own standard.”