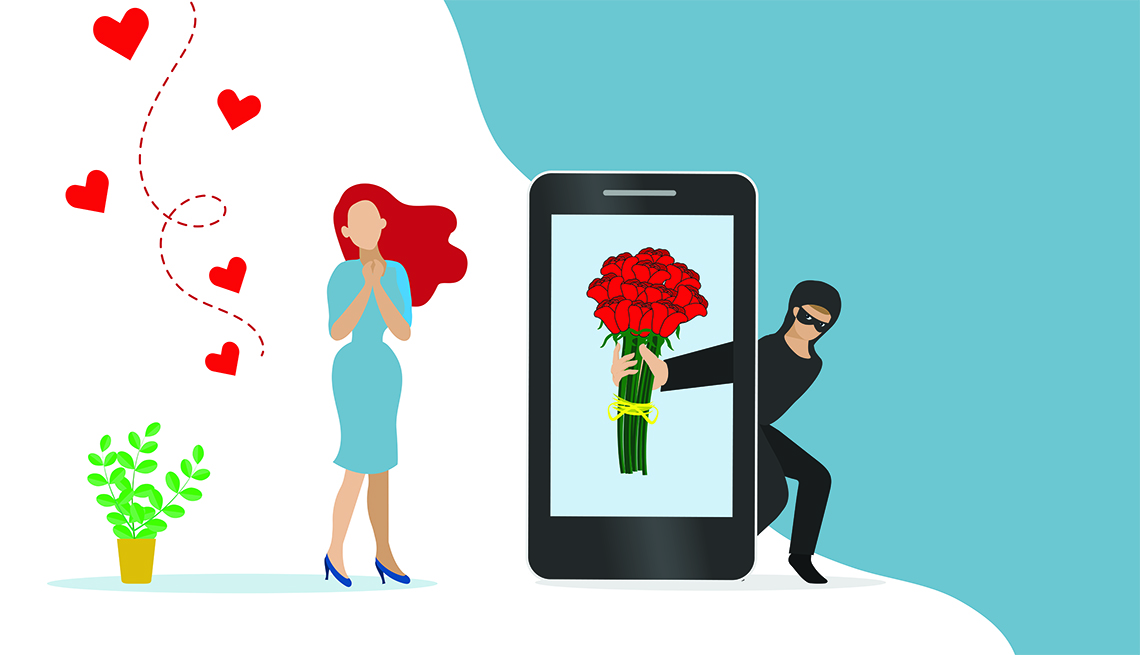

It’s Valentine’s Season; a time for love and…romance scams. As millions of people swipe left or right looking for a romantic match, fraudsters are also online seeking their one (or many) true mark(s).

How appropriate, that the new Netflix documentary, The Tinder Swindler, is rising in popularity just in time for Valentine’s Day.

The Tinder Swindler both offers viewers a crash course in the dangers of romance scams and a blueprint for banks to protect their customers.

Warning. The rest of this article contains spoilers for Netflix’s The Tinder Swindler.

What The Tinder Swindler Reveals About Romance Scams

“You can find a bit of everything on Tinder.”

That’s one of the opening lines from the documentary which chronicles three women who have one thing in common: they were all defrauded by a con man known as Simon Leviev.

In the film, the three women reveal how they met Leviev on Tinder. He claimed to be a billionaire and the heir to an Israeli diamond fortune.

The first date was an international trip on a private jet and a stay at a five-star hotel. He dripped with opulence – $5,000 a night at resorts, parties in exclusive clubs, cavorting with models, and dressed in the most expensive high-end luxury brand clothing and accessories.

His social media profile, as well as a Google search, appeared to back up his story, producing images that resembled scenes from a James Bond movie.

But while the romance started as a fairy tale, it ended as a cautionary nightmare. Soon after dazzling them into believing he was ultra-wealthy, Leviev told his targets that he was in trouble. He convinced them that dangerous people were looking for him. He claimed it was too risky to use his own credit cards and pressured his victims into sending him money from their savings accounts.

They even applied for loans, opened new credit cards with higher balances which they eventually turned over to Leviev who quickly maxed them out.

The victims each describe how red flags went off as they took on massive debts for the man they believed they loved. But when they confronted him with their concerns, they were met with a mix of gaslighting, paranoia, and even threats of violence. In the end, they all acknowledge that they will never be the same again after their romance scam.

How Banks Can Protect Customers from Romance Scams

The underlying message of the documentary is that it is very difficult, if not impossible, to catch a romance scammer and bring them to justice. After the credits for The Tinder Swindler have rolled, the victims are still saddled with massive debts.

Meanwhile, Leviev is free after serving a 15-month prison sentence and is using dating apps again. He was recently banned from Tinder and other online dating services.

Fraudsters aren’t limited to dating services like Tinder, Bumble, or Match. Social media platforms like Facebook and Instagram also give fraudsters access to numerous targets. The U.S. Federal Trade Commission (FTC) recently found that romance scams were the second most profitable fraudulent activity pushed on social media platforms in 2021 (behind only fake cryptocurrency investments).

The latest figures from the FBI, meanwhile, found fraudsters defrauded U.S. consumers out of $133 million. Bear in mind that these are just the figures reported to the FBI and FTC. There are likely many other cases reported to banks that go unreported to government agencies.

Romance scams are also common outside the U.S. In the U.K., for example, this activity rose by 40% last year. Meanwhile, the latest figures from Australia estimate that romance scam losses came close to $37 million in 2020.

Victims of romance scams – as The Tinder Swindler depicts – often feel humiliated and so scarred by their experience that they are reluctant to tell police, banks, or their families about the betrayal.

Like the victims in the film note, by sharing their experiences, they also invite public shaming on social media. But banks can step in to protect their customers from falling prey to romance scams – and keep them from becoming the subjects of future true crime documentaries.

1. Know Your Customers

Banks should understand who their customers really are and how they typically transact to detect if their behavior raises any alarms. Sudden shifts in behavior are red flags. These include:

- suddenly opening loans;

- applying for new credit cards (and quickly maxing them out);

- raising spending limits;

- transfers to other recipients;

- buying plane tickets for other people;

- expensive transactions in international locales.

If customers are behaving far outside their normal patterns, intervene to stop the transactions before a transfer or transaction is completed.

2. Educate Consumers on Romance Scam Dangers

At the end of the day, consumers are the best line of defense against fraud. Banks should educate and train their consumers on how to spot the signs of a romance scammer (such as someone who suddenly needs money for medical expenses or travel).

Partnering with organizations like the FTC, the Better Business Bureau, or other advocacy groups can help banks raise awareness and better prepare their customers to stay clear of fraudsters preying on their romantic interests.

3. Employ Machine Learning

At the end of the day, we’re only human. Unfortunately, fraudsters will prey on the need for human connection to defraud victims using romance scams and other tactics. But human beings will also struggle to see sinister connections in a customer’s normal behavior amid large quantities of data.

That’s why machine learning and fraud prevention are made for each other. To protect their customers’ finances and hearts, banks need advanced technology that can uncover patterns that would otherwise go unnoticed by the human eye..

The Tinder Swindler focuses on just one of the many romance scammers who defraud unsuspecting victims. As one of the subjects says, “One little swipe can change your life forever.” With this in mind, banks need to watch out for customers as they search for love online.