Making sure about subsidizing during crucial occasions is a test for most entrepreneurs. Elective loaning offers various choices, including working capital credits, trader loans, hardware financing, receipt considering, and term advances. Private venture advances can help you begin or keep up your business. What’s more, however, fixed loaning norms may make getting credit more troublesome. Figuring out how to explore the cycle early will assist you with being fruitful.

The standard interest rate for small business advance shifts relying upon your capabilities as a borrower, the kind of credit you’re applying for, and which bank you select. Advances from customary moneylenders, for example, banks or credit associations, can have yearly rate rates (APRs) going from 3% to 7%. In comparison, elective or online advances can have APRs going from 7% to over 100%.

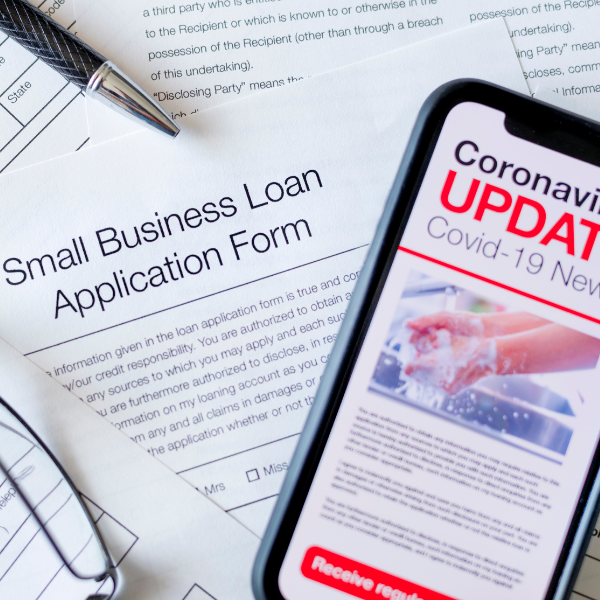

Except if your private company or small business is self-financed or supported by financial specialists, you’re probably going to require an independent venture advance to help you begin or develop your business. Usually offered by banks, business credits show a truly necessary imbuement of money to cover most expenses. However, numerous entrepreneurs think it’s challenging to be endorsed. When you hope to acquire a small business loan from a bank, it’s essential to keep in mind the accompanying data, terms and conditions, and tips so you can all the more rapidly and effectively get affirmed.

So, if you are somebody on the lookout for a private company advance, you’re in the ideal spot. With all the financing choices out there, attempting to think about business credits can feel overpowering. In this gathering, we’ll mention what makes these loan specialists extraordinary and help you find out which is the best fit for your small business.

Choose what kind of credit you need

Moneylenders will inquire as to why you need outside financing. Your answer will probably be categorized as one of four classes that you are willing to start your business or oversee everyday costs (think finance and stock). If you already have a running business and you want to develop your business to the next level. You are willing to give wellbeing net.

Your thinking will figure out which kind of independent venture credit you can get. For instance, if you are beginning a business, it isn’t easy to get an advance from a bank or online moneylender in your organization’s first year. Moneylenders require income to help reimbursement of the credit, so new businesses are commonly excluded from financing. All things being equal, you will need to depend on business charge cards, acquiring from loved ones, crowd funding, individual advances, or different kinds of startup financing.

Small Businesses with a year or a more significant amount of history and income have additional financing choices, including government-sponsored advances, term advances, business credit extensions, and receipt considering.

Some practically essential things to consider when choosing a business loan

Business loans from a conventional bank are probably the most pursued financing choices for independent companies on account of the security nets intrinsically found in traditional banking. Upheld by the central government, banks, and the more significant part of their items, accompany affirmations that numerous nontraditional and web-based financial lessors don’t. Additionally, bank credits, for the most part, convey lower financing costs than advances from online moneylenders.

As an entrepreneur, you have numerous choices to browse regarding the various sorts of business financing. Each kind of credit accompanies its arrangement of specifications, prerequisites, and different models that may improve one a fit for your monetary occurrence and reimbursement capacities than severals.

In the wake of concluding that your small business would profit from a business loan, for the time being, you must make sure about precisely what kind of credit you need to look for in the future. Abandoning to do so can bring about lost time, sunken expenses, and other significant cerebral pains for any independent company.

What’s your FICO rating?

You can get your credit report for nothing from every one of the three significant credit departments: Equifax, Experian, and TransUnion. You can likewise get your FICO rating for nothing from a few charge card guarantors and individual accounting sites, including NerdWallet.

Banks like to offer their low-rate business advances to borrowers with FICO assessments over 680 in any event, says Suzanne Darden, an accounting expert at the Alabama Small Business Development Center. If your FICO rating falls beneath that limit, consider online independent company advances for borrowers with awful credit or passages from a philanthropic microlender.

How long have you been doing business?

Notwithstanding your FICO rating, loan specialists will consider how long your business has been working. It would be best if you did business, at any rate, for one year to meet all requirements for most online private venture advances and, in any event, two years to fit the bill for most bank advances.

Do you bring in enough cash through your business?

Numerous online banks require a base yearly income, which can go somewhere in the range of $50,000 to $250,000. Figure your income and discover the base a given bank needs before you apply.

Would you be able to manage the cost of the installments?

Take a gander at your business’ financials significantly income and assess the amount you can stand to apply toward credit reimbursements every month. Some online banks require day by day reimbursements, so make a point to figure that.

To serenely reimburse your advance every month, your full payment should be at any rate 1.25 occasions your all-out costs, including your new reimbursement sum, Darden says. For instance, if your business’ pay is $10,000 per month and you have $7,000 of costs, including rent, finance, and stock, the most you can serenely manage is $1,000 per month in advance reimbursements.

Assemble your documents

Before you apply for an advance, you likewise need to ensure you have all the necessary documentation. Finding these documents now and having them effectively open will assist further with smoothing out the cycle.

Contingent upon the loan specialist, you will need to present a blend of the accompanying:

- Business and personal expense forms like taxation returns.

- Business and personal bank account statements.

- Fiscal statements of your business.

- Your business’s authoritative and legal documents like articles of fuse, business rent, establishment arrangement).

- Your Business Strategy.

Terms to look for in a business credit contract

Other than the kind of advance you apply for, think about the subtleties of the credit. Each passage accompanies its own financing cost and advances term, among different purposes of thought that are as similarly significant as the kind of credit you take on. It’s essential to peruse the agreement in full to ensure there aren’t shrouded terms or charges.

While applying for a bank advance, check the accompanying:

Interest Rates: Aside from the measure of cash you wish to get, the credit rate, also called the loan cost, is something you totally should decide. Advance rates vary dependent on the kind of advance you’re chasing, the bank you’re acquiring the assets from, and your own FICO assessment, in addition to other things. When searching out a business credit, you need one with a low loan fee, if conceivable. Contingent upon the sort of credit, you may see rates range somewhere in the range of 3% up to 80% yearly rate.

Terms and conditions on the loan application: A business credit term is when you need to take care of the advance. Like the credit rate, you, by and large, need a more limited advance term on the off chance that you can bear the amount of the loan installments. The more drawn out your rate is, the more premium you will pay over the long haul, and the more your advance will cost, generally speaking.

Banking relationship: To be considered a bank business credit, numerous organizations necessitate that you have a current relationship with them first. If this isn’t the situation, you’ll need to open a record with a bank and set up a working relationship with it over the long run.

What do banks search for in an application for a small business loan?

Fundamentally, it would be best if you remembered a bank’s prerequisites. Each bank has its credit application structures while applying for a small business loan. Numerous establishments offer their applications on the web. However, some actually expect you to round out a paper structure. In light of the advance sum and the sort of credit you’re chasing, the bank may have a favored strategy for applying.

Notwithstanding how a bank likes to get an advanced application, you should likewise consider the requirements that a bank needs to be considered for endorsement. Numerous elements go into a likely acceptance.

Apply for a small business loan

Since you’ve figured out which kind of moneylender is ideal for you, take a gander at a few comparable alternatives dependent on credit terms and yearly rate. The highest quality level for contrasting advances, APR is the best gander at your total expense of getting for the year since it incorporates all advance charges notwithstanding the loan fee.

Of the advances you meet all requirements for, pick the one with the most reduced APR (insofar as you are ready to deal with the advance’s standard installments), and apply with the records you have accumulated. Note that credit departments don’t separate between business and individual requests. Your FICO assessment could be influenced while applying for an independent venture advance on the off chance that you utilize your record of loan repayment, which is the reason it’s imperative to go with your smartest choice.

Get your financials all together. As indicated by one expert, a candidate ought to have their financials all set. To do this, ask the bank what data they will require while experiencing the application cycle comparative with the sort of advance you’re chasing and the solicitation size. To this end, you ought to by and large attempt to have three years of business and personal expense forms close by just as a year-to-date benefit and misfortune figures, monetary records, money due to maturing reports, and stock breakdowns if conceivable.

Make a field-tested strategy. In case you’re looking for credit as a startup, it’s essential that you likewise have your strategy drawn up.

Gauge the amount you will require if you need a credit for a sometimes buys financing choice. It’s additionally imperative to have gauges for the work or buy prepared to show the advance official.